The Poor Rate

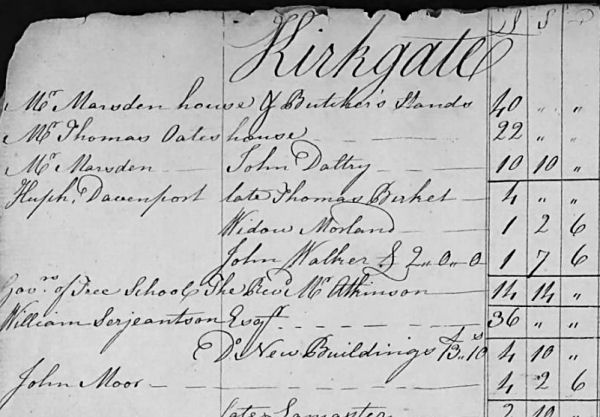

The 1601 Act empowered parish overseers to raise money for poor relief from the inhabitants of the parish, according to their ability to pay. The poor-rate was originally a form of local income tax, but over time evolved into the rating system — a property tax based on the value of real estate. In general, the poor-rate was paid by the tenant of a property rather than its owner. Each parishioner's property and payment would be recorded in the Overseers' accounts books.

Example of an Overseer's poor rates accounts book from Wakefield, 1770.

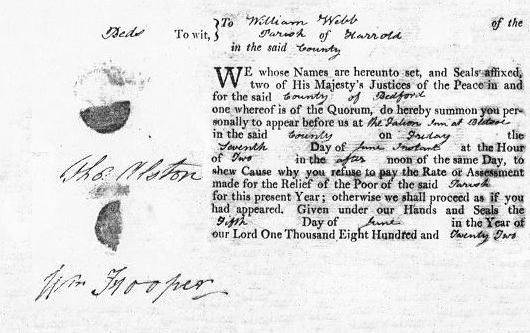

Failure to pay the poor-rate would result in a summons to appear before a Justices of the Peace who could impose a fine or the seizure of property, or even prison.

Example of a poor rate summons from 1822.

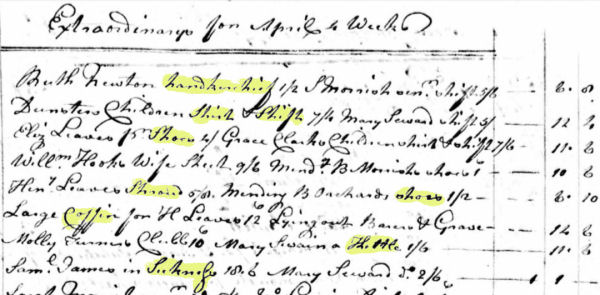

The poor rates funded payments to the needy poor in the parish, in cash or to pay for items such as those highlighted in the example below: handkerchief, a shirt, shift, shoes, a coffin, a kettle, or in sickness. Such handouts were known as out-relief.

Example of out-relief payments at Lyme Regis in 1796.

.Bibliography

- Slack, Paul. The English Poor Law, 1531-1782, 1990, CUP.

- Webb, Sidney and Beatrice English Poor Law History, 1927, Longmans, Green & Co., London.

- Webb, Sidney and Beatrice English Poor Law Policy, 1910, Longmans, Green & Co., London.

Unless otherwise indicated, this page () is copyright Peter Higginbotham. Contents may not be reproduced without permission.